Which CIMB Credit Card Should You Use Overseas?

- Nov 22, 2025

- 7 min read

With peak travel season approaching, many CIMB cardholders holding both the CIMB Preferred Visa Infinite and the CIMB Travel World Elite will naturally ask the same question: which card should I actually use overseas?

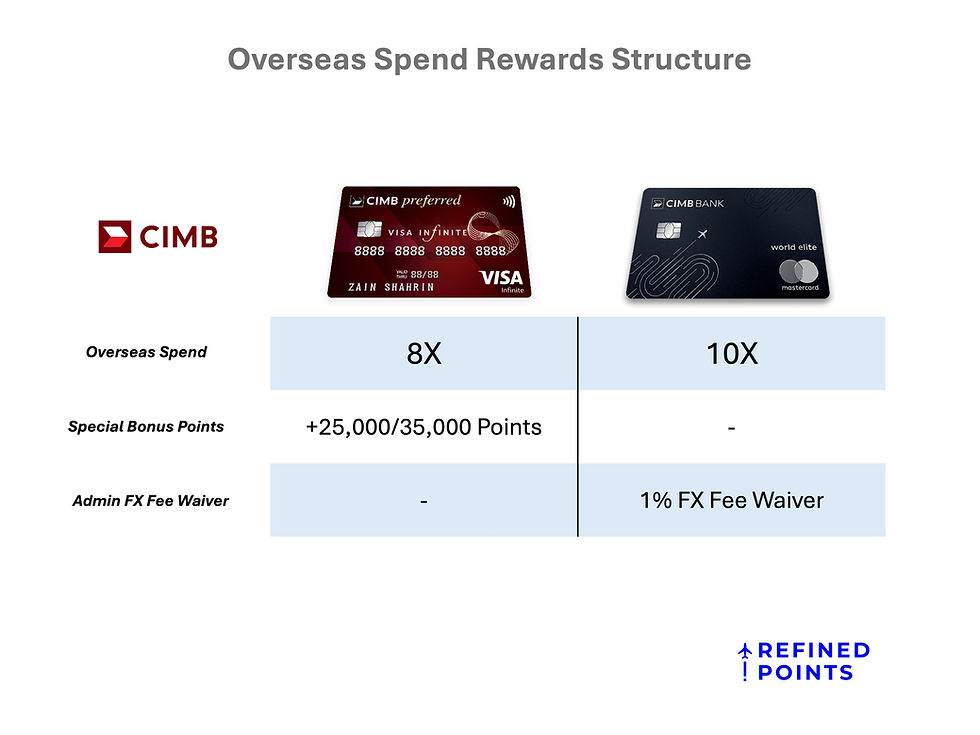

On paper, both cards look strong for travel. The CIMB Preferred Visa Infinite earns 8X Bonus Points on overseas spend and now has a revised bulk bonus structure that awards 25,000 or 35,000 extra points depending on your total statement spend.

The CIMB Travel World Elite earns 10X Bonus Points on overseas spend and offers an evergreen 1% admin FX fee waiver, effectively reducing your foreign currency charges compared to a typical Malaysian credit card.

Both cards share the same points-to-miles conversion rates. Converting to Enrich miles, 12,500 CIMB Bonus Points gives you 1,000 miles. Converting to other airline partners such as KrisFlyer, Asia Miles and Avios, 15,000 CIMB Bonus Points gives you 1,000 miles.

If you translate their overseas earn rates into miles per ringgit, ignoring the bulk bonus for a moment, the math is straightforward.

On the CIMB Preferred Visa Infinite, 8X Bonus Points per ringgit overseas works out to about 0.64 Enrich MPR or roughly 0.53 MPR for other airline partners.

On the CIMB Travel World Elite, 10X per ringgit overseas is about 0.8 Enrich MPR or around 0.66 MPR for other airline partners.

In other words, purely on base earn, the Travel World Elite wins. It gives you more miles per ringgit and charges a lower FX fee thanks to the 1% waiver. The only reason the Preferred Visa Infinite enters the conversation for overseas spend is because of its bulk bonus, particularly at the RM10,000 tier.

The key question is not “which card earns more points”, but “is it worth paying higher FX fees to unlock a small number of extra miles from the bulk bonus?”

Scenario 1: You Never Hit RM8,000 On The Preferred Visa Infinite

If your total monthly CIMB Preferred Visa Infinite statement spend is below RM8,000, the bulk bonus is irrelevant. You do not receive the 25,000 or 35,000 bonus at all.

In that world, the Preferred Visa Infinite behaves like a straightforward 8X card with standard foreign currency fees, while the Travel World Elite behaves like a 10X card with a lower FX cost.

Here, the answer is extremely simple. If you hold both cards and you are not going to hit RM8,000 in total Preferred Visa Infinite statement spend, you should not be using the Preferred Visa Infinite for overseas transactions. The CIMB Travel World Elite should be your default card for all non-MYR spend.

Scenario 2: You Hit RM8,000 Or RM10,000 On Preferred Visa Infinite Without Overseas Spend

Now consider a higher-spend profile. Perhaps you have large local and recurring expenses that you can consolidate on the CIMB Preferred Visa Infinite every month. Insurance, utilities, education, membership fees, domestic dining and retail can all be directed to this card.

If your usual pattern of local and online spending already pushes your Preferred Visa Infinite statement above RM8,000 or even RM10,000 before you even step on a plane, then you have effectively “locked in” the 25,000 or 35,000 Bonus Points in every statement cycle.

In that situation, the bulk bonus on the Preferred Visa Infinite becomes background noise. You are receiving it regardless of what you do overseas.

When it comes to travel, the CIMB Travel World Elite once again comes out ahead. It earns more MPR overseas and charges a lower FX fee thanks to the 1% waiver. There is simply no need to force your overseas spend onto the Preferred Visa Infinite if the bulk bonus is already triggered by your local life.

For this type of cardholder, the optimal strategy is as follows: use the CIMB Preferred Visa Infinite for large local and recurring spend to secure the bulk bonus, and use the CIMB Travel World Elite as your primary overseas workhorse for all foreign currency transactions.

Scenario 3: You Only Cross RM10,000 On Preferred Visa Infinite Because Of Overseas Spend

The most interesting scenario is where you only cross RM10,000 on your Preferred Visa Infinite if you deliberately put your overseas spend on it.

Imagine a big travel month where you are planning RM10,000 of overseas spend. Without this trip, your usual local Preferred Visa Infinite spend sits below RM10,000 and does not qualify for the 35,000 tier. Now you must decide: do you channel that RM10,000 abroad to the Preferred Visa Infinite to unlock the 35,000 Bonus Points, or do you charge it to the Travel World Elite and forego the bulk bonus?

At RM10,000 of overseas spend, the Preferred Visa Infinite earns 80,000 base points from its 8X rate, plus 35,000 Bonus Points for crossing RM10,000, giving you a total of 115,000 points. The Travel World Elite at 10X would earn 100,000 points on that same RM10,000.

The Preferred Visa Infinite therefore generates an extra 15,000 points compared to the Travel World Elite at this spend level. Converted to miles, that 15,000-point gap is worth about 1,200 Enrich Miles or 1,000 miles with KrisFlyer, Asia Miles, Avios and other partner programs.

To get this small chunk of extra miles, you pay more in FX fees. The Travel World Elite enjoys a 1% admin FX fee waiver, which means using the Preferred Visa Infinite instead effectively costs you about 1 percent more in FX charges on that same RM10,000 overseas.

That is roughly RM100 of extra FX cost for 1,000–1,200 miles. In simple terms, you are buying miles at around 8–10 sen each.

For the majority of casual travellers who redeem mostly economy flights or are not maximising sweet spots, paying RM100 just to squeeze out an extra 1,000 or so miles is not a great trade. The lower FX fee and higher base earn on the Travel World Elite more than compensate for skipping the bulk bonus.

For hardcore mileage collectors who consistently redeem premium cabin awards at high value per mile, the calculation is more nuanced. If you are regularly redeeming at values well above 10 sen per mile, paying RM100 to pick up an additional 1,000–1,200 miles might be acceptable.

Even then, it is hardly a game-changer; it is a margin tweak, not a major upgrade.

What about the RM8,000–RM9,999 band?

The new RM8,000–RM9,999 tier on the Preferred Visa Infinite is most useful when it is triggered by your normal pattern of spending, not when you are deliberately stuffing overseas spend into the card.

Take RM9,000 abroad as an example. On the Preferred Visa Infinite, you would earn 72,000 base points (9,000 x 8X) plus 25,000 Bonus Points, for a total of 97,000 points. On the Travel World Elite, RM9,000 would earn 90,000 points.

The Preferred Visa Infinite leads by 7,000 points, which is roughly 560 Enrich Miles or around 470 KrisFlyer/Avios miles. In exchange, you have paid around RM90 more in FX fees compared to using the Travel World Elite.

Once again, the value proposition is weak. You are paying a meaningful amount of additional FX cost for a very small number of extra miles. This is why it is best to treat the RM8,000 tier as a bonus when your existing spending organically crosses it, rather than something you chase through foreign currency spend.

Simple Rule of Thumb

To keep things fool-proof for travel season, you can boil all of this down into a few simple rules.

If your CIMB Preferred Visa Infinite statement spend usually stays below RM8,000, just ignore the bulk bonus and use the CIMB Travel World Elite for all overseas spending. You earn more miles per ringgit and pay lower FX fees.

If your normal local and recurring spend already pushes the Preferred Visa Infinite past RM8,000 or even RM10,000 without depending on overseas charges, treat the bulk bonus as a background perk. Continue using the Preferred Visa Infinite locally, and rely on the Travel World Elite as your main overseas card.

Only if you are a serious miles enthusiast, comfortable with the idea of “buying” miles at around 8–10 sen each, should you consider deliberately routing overseas spend to the Preferred Visa Infinite to push your statement past RM10,000. Even then, you should switch to the Travel World Elite for any spend beyond that point to keep your FX costs under control.

Final Thoughts

I first thought of writing this article as I was publishing the new CIMB Preferred Visa Infinite tiered points structure, as I've had several emails on this recently. I'm well aware that most Refined Points continue to utilize the CIMB ecosystem, so this article should provide you with relevant information.

When you line up the numbers, the CIMB Travel World Elite is the more straightforward and efficient overseas spending tool for most cardholders. It earns more MPR on foreign currency transactions and reduces your FX costs with its 1% admin fee waiver. If you want a simple, low-effort strategy, using the Travel World Elite for all overseas spend is the easiest recommendation to make.

The CIMB Preferred Visa Infinite, on the other hand, is better viewed as a powerful local dining and recurring spend engine. Its bulk bonus structure, especially with the new RM8,000 tier, rewards cardholders who naturally consolidate large portions of their expenses on the card. When used this way, it quietly generates a healthy stream of extra points in the background.

The trap is trying to force the Preferred Visa Infinite into a role it is not optimised for. If you find yourself deliberately swiping it overseas just to hit RM8,000 or RM10,000, you are often paying extra in foreign currency fees for a relatively small number of additional miles.

That may be acceptable for a minority of highly sophisticated mileage collectors, but it will not make sense for the average traveller.

Going into peak travel season, a clean setup works best. Let the CIMB Preferred Visa Infinite handle your big local and recurring payments to lock in its bulk bonus, and let the CIMB Travel World Elite do what it does best as your primary overseas companion.

You'll earn strong rewards, avoid unnecessary FX leakage, and keep your card strategy simple enough to actually follow while you are on holiday.

Comments